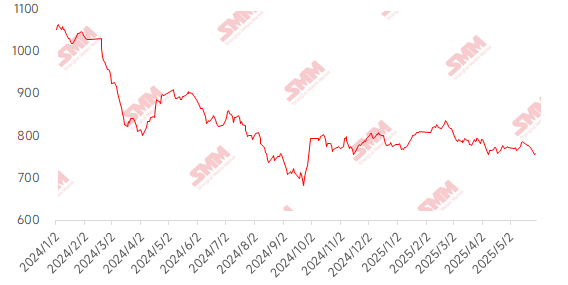

This week, imported iron ore prices fell sharply, primarily due to the dual pressures of the implementation of crude steel production reduction policies and a weakening fundamental outlook. Shandong, Anhui, Fujian, and other regions have clarified their crude steel production control targets, with some steel mills planning to reduce their annual output by 5%-10%, directly suppressing expectations for iron ore demand. Although the potential easing of US tariff policies provided a temporary boost, the industry has entered the traditional off-season, with insufficient momentum for a rebound. In the spot market, the weekly average price of PB fines at Shandong ports fell by 26 yuan/mt WoW.

Chart: SMM 62% Imported Ore MMi Index

Source: SMM

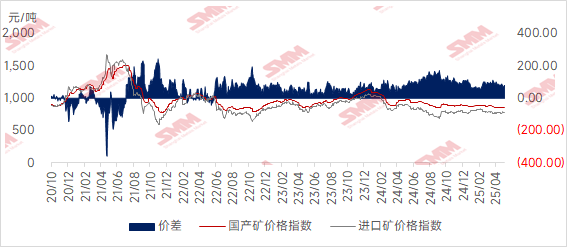

This week, prices in Tangshan, Qian'an, and Qianxi in Hebei Province, as well as Chaoyang, Beipiao, and Jianping in west Liaoning, fell by 1-5 yuan/mt. In east China, prices fell by 10-15 yuan/mt.

In the Tangshan region of Hebei, the dry-basis ex-factory price (tax included) of 66% iron ore concentrates fell by 10-15 yuan/mt this week, now ranging from 920-925 yuan/mt. The resumption of production at local iron mines has been slow, with limited marketable resources available. On one hand, some producers have significantly low inventory levels and are reluctant to sell goods without the ability to restock. On the other hand, mines and beneficiation plants are struggling to release high-cost inventory. Considering the insufficient demand from steel mills due to their low allocation of domestic ore, weak demand is constraining upward price momentum, with both supply and demand being weak.

In west Liaoning, iron ore concentrate prices are in the doldrums, with the 66% wet-basis ex-factory price (tax excluded) ranging from 690-700 yuan/mt. Traders' risk-aversion sentiment has intensified, with general inquiry enthusiasm. The mines and beneficiation plants sector recently faced tailings mine inspections, but the impact on local production has been relatively small. Currently, market buyers lack confidence in the future outlook, with steel mills primarily purchasing based on immediate needs. Additionally, iron ore futures are in the doldrums, and the cost-effectiveness of domestic iron ore is weakening.

In east China, mines and beneficiation plants are mostly operating as planned, but the overall pace of shipments has slowed. Currently, domestic iron ore concentrates are less cost-effective compared to imported ore, so local steel mills are mainly purchasing as needed and have appropriately increased their use of imported ore.

Chart: Price Spread Between Domestic and Imported Ores

Source: SMM

Outlook for Next Week

For imported ore: Entering June, mainstream mines in Australia and Brazil are entering the end-of-quarter production push phase. However, the current sluggish ore prices may curb shipments from some non-mainstream mines, with global shipments expected to increase only slightly. Domestic ore production may drop back slightly due to weakening demand and environmental protection constraints, with overall supply pressure remaining limited. On the demand side, pig iron production has slightly decreased but remains at a high level. Port inventory may continue to destock slightly, with fundamental support continuing to weaken. Although the crude steel production reduction policy will continue to disrupt the market, its impact on sentiment may gradually diminish. Overall, SMM expects ore prices to remain in the doldrums next week, with limited upside and downside potential and a narrower range of fluctuations.

From the perspective of domestic ore: In general, the supply of domestic ore remains tight recently. However, the futures market for iron ore has been weak recently. Coupled with the declining cost-effectiveness of domestic iron ore concentrates, the overall market transactions for domestic ore have been sluggish. Additionally, the low cost-effectiveness of domestic ore has led to poor overall market demand. It is expected that domestic iron ore prices will remain in the doldrums next week.

》Click to view SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)